Promising Cryptocurrencies

Top 12 promising cryptocurrencies for 2024

Discover our top 12 cryptocurrencies to watch and in which it could be interesting to invest in 2024. This year, we are touring the industry with 7 categories of projects highlighted: the essentials, decentralized finance, gaming, interoperability, blockchain / real-world relationship, scalability, and layer 2 protocols.

Introduction to Promising Cryptocurrencies

The year 2024 begins, and it’s time to take a look at which cryptocurrencies could be likely to outperform during this year.

In this file, we have separated the cryptocurrencies that seem interesting to us for 2024 into several categories:

- The unavoidable ;

- Decentralized finance (DeFi);

- The blockchain / real-world relationship;

- Gaming and non-fungible tokens (NFTs);

- Ethereum layer 2 protocols;

- Scalability;

- Interoperability.

This article does not constitute investment advice in any way, you should always do your own research before investing. Additionally, investing in cryptocurrencies is extremely risky and you should only invest what you are prepared to lose!

Evaluation Criteria of the Promising Cryptocurrencies

The cryptocurrencies presented in this dossier all meet specific criteria.

First of all, each cryptocurrency must be available on a leading platform, such as Binance, Bitfinex, Coinbase, or Kraken.

Its liquidity on the markets and its capitalization must be sufficient to limit any potential manipulation.

The fundamental aspect is the most important criterion here. The project must have concrete use cases and its cryptocurrency have a real utility.

The project must have some adoption and have entered into quality partnerships with other companies, in the cryptocurrency sector or not. The activity of the development team was also taken into account.

The last criterion, the project must be active on social networks and present the progress of its project to its community.

The unavoidable

Bitcoin (BTC)

We no longer present it, Bitcoin (BTC) is the king of crypto-currencies. For the moment, he is setting the pace for the entire market. If it collapses, there is little chance of seeing many cryptocurrencies go up.

If you own cryptocurrencies then, in our opinion, it is essential to own Bitcoin. In this ultra-volatile universe, it is one of the least “moving” assets and the one that can be considered the most “stable” even if it happens to gain or lose several tens of percent in a few hours.

In 2020, Bitcoin proved its rock-solid resilience to the world, recovering quickly from the market flash crash that took place in mid-March. This period during which Bitcoin fell to $3,800 is ancient history.

Quickly after this descent, Bitcoin rose to its initial level, before starting a steady progression towards heights never before reached. $20,000, $30,000 and even $40,000, Bitcoin managed to conquer the market once again at the end of 2020.

Institutions and banks across the globe have turned to Bitcoin in 2020, finally realizing its potential as an investment. They no longer hesitate to communicate about their bitcoin purchases, which contributes to the increase in its price over the long term. It is now undeniable, Bitcoin is considered an investment in the same way as gold. While it does indeed remain volatile, those who hold Bitcoin for the long term are still winners, at least until today.

In 2021, Bitcoin should continue to amaze us, and will certainly have some nice – or bad – surprises in store for us. Either way, in our view, any cryptocurrency investor should allocate some of their capital to Bitcoin.

Remember that Bitcoin is the conductor of this entire market. All other cryptocurrencies are sensitive to their movements, whether up or down.

Is it a good thing that the majority of bitcoins are bought by millionaires, billionaires, and a few corporations? We are not convinced, but we will see what 2021 has in store for us!

Transaction fees are also likely to explode on Bitcoin with more massive use by institutions, which may reduce its use by individuals. Second-layer solutions exist such as the Lightning Network or Liquid, we will have to closely monitor their developments over the next few years.

👉 Understand everything about Bitcoin (BTC)

👉 How to buy Bitcoin?

Ethereum (ETH)

No need, either, to present this cryptocurrency. Second capitalization of the industry for several years, Ether (ETH) of the Ethereum network is at a turning point in its history. Here are the 4 points that we think are important to follow.

1 – Ethereum 2.0

The first phase of Ethereum 2.0 started on December 1, 2020. As a reminder, ETH 2.0 will change Ethereum’s consensus mechanism (more specifically the transaction validation system). The network will switch from Proof of Work to Proof of Stake. This will enable scaling and greatly increase the capabilities of Ethereum. Vitalik Buterin, one of the founders, speaks of several thousand transactions per second, instead of 30 at present.

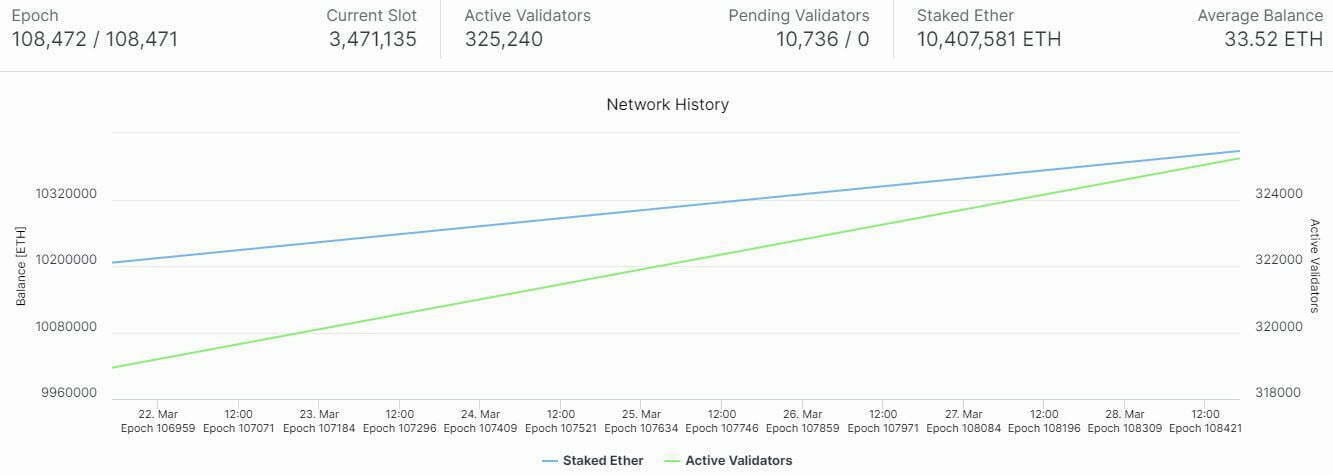

The number of validators and staked ETH keeps growing. On March 28, 2022, no less than 10 million ethers were blocked and nearly 325,000 active validators.

We believe that if the migration to Ethereum 2.0 goes well, the network should be used more and the price of ETH could appreciate. However, we will not see this complete migration before, at least, 2022. By then, will Ethereum Killers manage to make their way and attract a lot of developers? Nothing is certain, but in any case, the competition is there.

2 – Decentralized finance (DeFi)

DeFi does not just seem to be a fad. The regulator of American banks even sees the future of these. We believe that we are not ready to see the end of decentralized finance and all that it allows: collateralized loans, flash loans, decentralized stablecoins, elastic stablecoins, governance tokens… hundreds of projects are created each month, more and more complex, but more and more interesting and promising!

3 – EIP 1559

Ethereum is criticized a lot, especially by bitcoiners, for not having a maximum number of ETH. It is therefore not, according to them, a hard currency. We are not going to decide who is right or wrong. However, the issuance of Ether over time is expected to significantly decrease if EIP 1559 (Ethereum Improvement Proposal) is accepted by the community.

This proposed update plans to burn some of the ETH fees that miners receive for their contribution, in order to balance the number of ETH in circulation.

4 – Layer 2 solutions

As transaction fees have become a big issue for Ethereum, many players have jumped in to reduce fees and allow more transactions to be executed. Among these players, we find Loopring (LRC), Matic Network (MATIC), and many others.

There are also companies like Optimism trying to scale Ethereum. This is a big challenge. Indeed, using a second layer network does not mean an absence of fees, because you still have to open and close a channel with the main chain of Ethereum and therefore pay fees.

It will be necessary to follow these developments closely to see if a solution stands out by allowing the creation of channels that can be used by decentralized finance applications and their thousands of users.

Some flaws in Ethereum

There are, in our opinion, still some black spots in Ethereum. At first, the network is subject to some centralization of full nodes.

Indeed, an Ethereum node is not easy to set up at home as a Bitcoin node can be. You have to be ready to invest a certain amount in it while going through providers like Amazon Web Services. This amount is even higher if you want to do it independently.

To have a complete node (fully archived), it will take close to 1,000 €. Indeed, the Ethereum blockchain is heavy, more than 6 terabytes, and requires a hard disk with high storage capacity even if solutions exist to reduce this size.

Only a few actors are able to run full nodes. Some companies have specialized in this niche such as the infrastructure provider Infura, but this can be a problem. Indeed, in 2020, Infura experienced a complete disruption of its services, and many Ethereum-based applications and services stopped working for several hours.

There are obviously lighter nodes that do not contain all the transactions since the creation of the blockchain, but we can consider that these nodes do not make it possible to ensure the complete history of transactions and interactions with smart contracts…

Second, transaction fees on Ethereum are colossal. When the network is congested, mainly “because” of DeFi, the fees for a simple transaction can rise to more than $10 and the fees for using smart contracts to several tens of dollars.

This considerably hinders its use by “small carriers” who are not ready to pay several tens of dollars to use decentralized applications on Ethereum. Some see this as a sign of good network health and that these problems can be solved via layer 2 (second layer) while waiting for Ethereum 2.0 to come online.

Decentralized finance (DeFi)

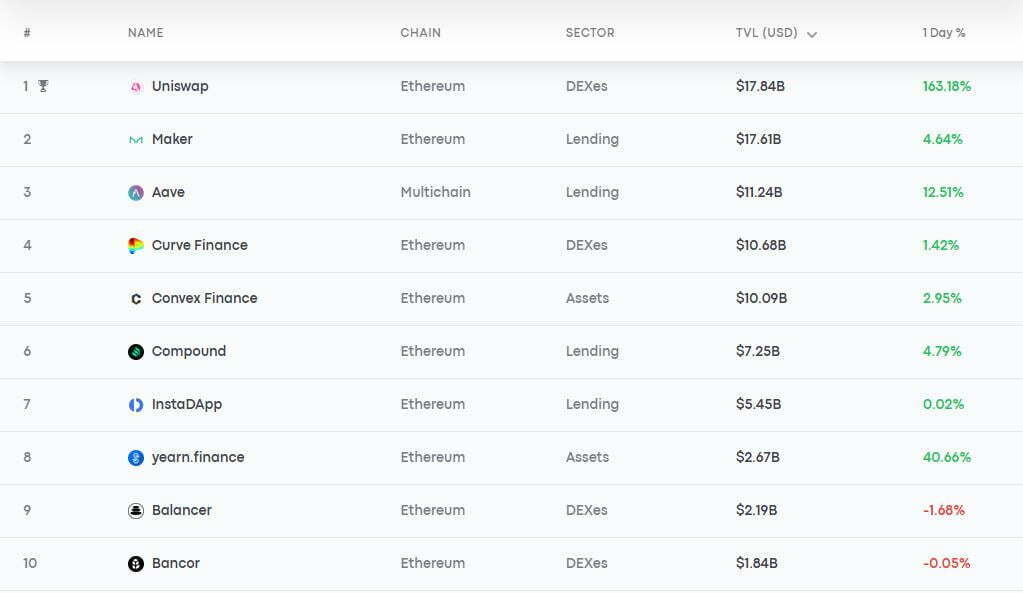

This is the subject of 2020, the explosion of DeFi. Amounts blocked in smart contracts have increased throughout the year and continue to do so. More than 24 billion dollars are locked there at the time of writing these lines.

Obviously many hacks have taken place, such as that of the Cover protocol and the -90% drop in its token. This is the risk when investing in a sector in full construction. Audits are carried out but do not always make it possible to highlight potential flaws.

In this selection of cryptocurrencies related to DeFi, we have chosen two safe values that have already proven themselves, both fundamentally and in terms of their security.

Aave (AAVE)

The first cryptocurrency in this category is AAVE. The utility token of the DeFi protocol of the same name has seen an incredible breakthrough throughout 2020. Its performance has been and continues to be, staggering.

By granting rights over the governance of one of the most popular and used DeFi protocols, the AAVE token is a must-have for any DeFi aficionado.

It can also be used to reduce protocol costs. These same fees in AAVE tokens are systematically burned, in order to gradually reduce the number of tokens in circulation, which increases its scarcity.

Regarding the Aave protocol, it seems to us to be one of the most promising in its sector. This open-source and non-custodial protocol allows its users to receive interest on the deposit of their cryptocurrencies and to borrow assets, all in a completely decentralized way.

As of this writing, Aave has over $3.3 billion locked in its protocol. Funds that propel Aave to second place among protocols in terms of capitalization.

Aave is undeniably one of the powerhouses of decentralized finance, and it’s likely to remain so. For 2021, the development team should have some nice surprises in store for us.

Indeed, at the end of 2020, the Financial Conduct Authority (FCA), the financial policeman of the United Kingdom, granted Aave an electronic money institution license. A first for a DeFi protocol that authorizes Aave to provide payment services on British territory, in the same way as those of the neo-bank Revolut. Currently, it is possible that Aave is working on a new product related to this license.

On social networks, Aave is particularly appreciated, especially for what it brings to DeFi from a general point of view. The token is also available for trading on the largest platforms, such as Binance, Huobi, and Coinbase.

So many good developments for this project which leads us to believe that its token will continue to climb in 2021.

Uniswap (UNI)

As of this writing, Uniswap is one of the most widely used decentralized applications in the world. Based on Ethereum, Uniswap is the leading DEX (Decentralized Exchange) in terms of volumes and total value locked (TVL)

The platform allows anyone to trade tokens with each other and without an intermediary through the use of smart contracts and AMM (Automated Market Makers). That is to say, pools of liquidity will replace the order books of a centralized platform to allow peer-to-peer trading. People are encouraged to deposit cash because in return they receive part of the fees charged by the smart contract. The fee is 0.3%.

All ERC-20 tokens can be traded as long as there is sufficient liquidity on one of its pairs.

At present its token, the UNI, mainly allows its holders to vote to modify certain parts of the protocol, but not the fees returned to them (0.05%). It also allows(tra?) those who own tokens to receive a portion of the fees charged by Uniswap as a reward. The more tokens you have, the greater the reward.

The owners of tokens are, for the moment, not very receptive and use their rights very little. It took until December 27, 2020, for the first proposal via a governance vote to be validated. It concerned the use of the fund allocation program to develop the Uniswap ecosystem.

It will be necessary to follow closely the evolution of the rights conferred by UNI tokens. We think the possibilities are endless. For example, UNI token holders could receive, in proportion to their number of tokens, the tokens of other projects that launch on the ecosystem. This is what you might call a fair launch.

Currently, the leader in DEXs, Uniswap is experiencing tough competition, many competitors are regularly emerging and actively developing, such as Sushiswap or Curve Finance. In 2021, it will be necessary to see if the competition will become more attractive than Uniswap or if it will continue to dominate the market and will exceed in terms of volume more and more traditional exchange platforms.

The blockchain / real-world relationship

The Graph (GRT)

A project born in 2017, The Graph is an indexing protocol for decentralized applications that allows developers to efficiently access blockchain data.

To put it simply, The Graph presents itself as the Google of the blockchain, where developers can search for data according to its nature.

For example, data from blockchains like Bitcoin, Ethereum, and many others are grouped into subgraphs, which can be queried by any programming interface (API).

The solution developed by The Graph allows applications to be truly decentralized, in the sense that they do not depend on any server or a single database, but rather on a network of nodes that will be incentivized to maintain the service running.

Apps like Aave, Decentraland, Uniswap, Synthetix, CoinGecko, Gnosis, Moloch, and many more are powered by The Graph services today.

This entire network works with the GRT, the token of The Graph. The latter allows network participants to receive rewards, which are paid by end-users who query the subgraphs.

The project has notably received financial support from Coinbase Ventures and ParaFi Capital.

As soon as the GRT token was introduced to the markets at the end of 2020, all major platforms supported it: Binance, Coinbase, Kraken, OKEx, KuCoin, and Huobi.

To sum up, The Graph has colossal development potential. By helping application developers to access a myriad of data on other blockchains, it is possible that The Graph will become indispensable in the years to come, provided that the protocol is adopted of course.

Tellor (TRB)

A competitor to Chainlink (LINK), the Tellor project provides a network of decentralized oracles.

An oracle is a tool for integrating real-world data, or data from another network, into blockchain and applications.

Thus, smart contracts can use off-chain data for their triggers and realizations. For example, contracts on Ethereum can trigger depending on the evolution of the price of Bitcoin in dollars.

This type of project has been very fashionable since the end of 2019, we can notably see it in the constant adoption of Chainlink as well as the explosion in the price of its token, the LINK.

The big advantage of Tellor is its fully decentralized network. Indeed, centralized oracles like Chainlink and others can be subject to hacks or malicious manipulations.

Thus, miners are responsible for securing the Tellor network and the data sent by the protocol.

When you want to obtain data, you have to request it from the Tellor oracle via TRB (Tributes), which are the tokens. It is possible to request to boost a request by adding tokens so that miners can process it as quickly as possible. Every 5 minutes, the most “requested” requests are grouped together, a Proof of Work mining competition is launched and the miners must solve it to win the tokens. Miners who want to participate in solving the problem must stake (keep) at least 1,000 TRB.

The miners, therefore, compete to process the request and provide the data (which is then added to a database) in order to win the reward. The first 5 miners who solve the mathematical problem win a mining reward as well as part of the tokens (50%) sent by people wishing to boost the request. The data can then be used by Ethereum smart contracts. If the data communicated by a minor is false, then he is sanctioned and loses part or all of the chips he has staked.

Indeed, each token owner can challenge data provided by a minor. If the challenge is validated by the other token owners, the one who initiated it wins tokens.

The negative point, the maximum number of TRB tokens in circulation is not defined. It’s an inflationary issue, which can be a problem. In effect, this means that new tokens will be continuously issued and that the price of these could stagnate or decrease in the long term. Note, however, that inflation decreases over time.

Note also that the team is remunerated with 10% of the tokens mined. This may seem like a lot to some, but they didn’t assign themselves any tokens on creation (premining).

Gaming and non-fungible tokens (NFTs)

Theta Network (THETA)

The Theta Network wants to decentralize streaming platforms and identifies itself as a direct competitor to Twitch.

Theta uses blockchain technology as well as cryptocurrencies to encourage Internet users to secure and use the network. Internet users can both watch a live video, but also share their resources and bandwidth so that others can watch it. In exchange for their contribution to the Theta network, those who allow the broadcast of streams receive THETA tokens.

According to the project’s official website, users can take part in the network on all types of devices: computers, mobile devices, connected TV, etc.

Theta’s goal is to be adopted by several video platforms. They claim that their solution will:

reduce infrastructure costs, as these are shared between network participants;

to increase engagement and the number of users through token rewards.

Since May 27, 2020, Theta has had its own blockchain and wallet. Moreover, two tokens coexist in this ecosystem.

Theta Token (THETA): it allows you to participate in the security of the network thanks to staking. It is also a governance token. The number of THETA tokens is limited to 1 billion units.

Theta Fuel (TFUEL): it remunerates broadcast viewers based on the time spent on them. People sharing their bandwidth also receive this token as a reward. The greater the sharing of resources, the greater the associated reward. Finally, it is also this token that network validators receive based on the number of THETA tokens they have staked. The number of TFUEL tokens is not limited.

The Theta network uses the Proof of Stake consensus and consists of several “layers” and types of validators:

- Enterprise Validator Nodes: those that allow you to create blocks. According to Theta, they are managed by Binance, Google, Samsung…;

- Guardian Nodes: those responsible for verifying that validator nodes are not malicious;

- Edge nodes (Theta Edge Node): those that share their bandwidth.

The Theta team also imagines smart contracts and decentralized applications combined with video streaming to further engage the community. Fundraising, distribution of royalties, allocation of tamper-proof “skins”, non-fungible tokens (NFTs)… the possibilities are numerous.

Now, it will be necessary to closely follow how the project develops. Is their solution used? Is the community, ie the number of streamers and viewers, increasing on their Theta.tv platform? Are Binance, Google, and Samsung really invested in the project?

Ultra (UOS)

A blockchain-based video game distribution platform, Ultra, and its UOS token create an entire ecosystem around gaming.

Ultra offers a new experience for both players and developers. By integrating blockchain into its platform, Ultra improves the interaction between video games and non-fungible tokens (NFTs).

UOS is the token that powers the Ultra platform, and it can be used in many ways, such as purchasing video games and virtual goods.

Since its inception, the Ultra project has been able to secure leading partnerships, in particular with major gaming companies such as AMD and Ubisoft.

In 2020, Ultra continued to strengthen this aspect, collaborating with Atari, Theta Network, The Sandbox, Cudo, and even Elrond (ERD).

With so many partners, the Ultra ecosystem is already quite complete, and even interferes in the heart of other projects, in particular for the creation of NFTs or the use of its infrastructure.

In addition, bridges between its UOS token and most of its partners have emerged. These can be used for certain services outside of Ultra, such as the purchase of an Atari console.

As of this writing, Ultra’s UOS token is available on major exchanges, such as Bitfinex and KuCoin.

By 2021, Ultra’s platform will gradually open to the public and will welcome thousands of users.

Also note that Ultra is the only French project featured in this top, another reason to keep an eye on it.

Ethereum Layer 2 Protocols

Loop ring (LRC)

We quickly covered Loopring (LRC) in the section dedicated to Ethereum.

This layer 2 protocol based on Ethereum improves the scalability of the network. It uses a solution called zkRollup to aggregate transactions between them, which limits the resources used on the network.

In this way, Loopring is able to process over 2,000 transactions per second, while maintaining the same level of security as Ethereum.

Another major advantage, the transactions executed on Loopring are exempt from fees. With zkRollup, Loopring achieves that a transaction costs an average of $0.00006 in fees, a low cost largely offset by the fees for deposits and withdrawals on its platform.

Indeed, Loopring also has its own decentralized exchange (DEX), on which it is possible to exchange Ether with many ERC-20 tokens, including the LRC, the token at the heart of Loopring’s operations.

Moreover, LRC token holders can provide liquidity to the protocol and in return receive a portion of the fees paid by exchanges built on Loopring. Yes, in addition to providing its own DEX, Loopring can accommodate anyone’s DEX.

Why is the LRC so interesting? For example, if someone decides to operate a Loopring-based DEX, they will first need to lock up at least 250,000 LRC, or around $90,000 at the time of this writing.

In addition, the use of LRC is encouraged to improve the operation of the network. For example, DEX operators on Loopring can have their deposited LRCs confiscated if they mismanage their platforms. If this happens, the funds are redistributed to users who lock their LRCs into the protocol.

Finally, note that 10% of the costs incurred by these platforms are burned, which reduces the total supply of LRC over time, a feature that benefits the rise in the price of the cryptocurrency.

To date, Loopring is particularly received by the crypto community, and even by Vitalik Buterin himself, who often praises the protocol on Twitter and on his personal blog.

Available on Coinbase, Binance, Huobi, or even OKEx, the LRC cryptocurrency seems promising to us for 2021. Loopring being in constant development, its underlying token should easily continue to keep an important place in the ecosystem.

Matic Network (MATIC)

Today, the vast majority of decentralized finance protocols are based on Ethereum. A load that weighs on the network, its capacities no longer being sufficient to keep up.

Ethereum is capable of processing 15 transactions per second, which is far too low to handle the DeFi industry on its own. Regularly, the network is congested, causing a colossal increase in transaction costs.

To address this problem while waiting for Ethereum 2.0 – certainly operational at the end of 2022 – there are layer 2 protocols based on Ethereum.

One of them is Matic Network, a network capable of processing up to 7,000 transactions per second. This protocol is a choice alternative to Ethereum, in addition to being fast, it is also eligible for staking, with an annual interest rate fluctuating between 25 and 35%.

The MATIC token is the native token of Matic Network, which can be used to pay fees for decentralized applications hosted on the network.

As of this writing, the Matic network is being solicited by the WazirX exchange for its Automated Market Maker (AMM) pool. Note that this Indian exchange platform belongs to the giant Binance.

Also, DeFi projects have chosen Matic Network over Ethereum. This is particularly the case of Aavegotchi, a community DeFi project subsidized by Aave.

In the expectation that Ethereum 2.0 will come to reinforce the current capabilities of Ethereum, Matic Network is starting to do well and would be likely to continue in this direction.

These particularities make the MATIC token particularly attractive. Thus, it is conceivable that MATIC will benefit from the continued development of the Matic Network in 2021.

By the way, MATIC is available for trading on major platforms, including Binance, Huobi, and HitBTC.

Scalability

Nano (NANO)

The Nano project uses a rather original type of consensus. It is considered a cousin to the blockchain, it is the DAG, for Directed Acyclic Graph. Other projects use this type of technology such as Avalanche (AVAX) or IOTA.

Nano’s goal is to become a digital currency, with instant transactions and virtually no fees, all on a secure network. This is called the blockchain triptych. We consider that it is currently impossible to combine these three characteristics: many transactions per second, decentralization, and security. Yet this is what Nano wants to do like a large number of cryptocurrencies said.

The Nano network uses consensus similar to the proof of stake. Owners of NANO coins can use them to secure the network.

The Nano community is quite large compared to other projects with similar capitalization. Many projects develop with concrete uses. There is also a foundation dedicated to Nano to participate in the development of the ecosystem and the development resources are numerous and well supplied.

If the use of Bitcoin (BTC) increases a lot in the next few months, fees and transaction times become very high, a part of investors could turn to projects trying to solve these problems, such as Nano.

In the past, the price of Nano has often soared when the Bitcoin network entered a congestion phase. It has this particularity that investors monitor at each market bull run. Be careful, this does not mean that Nano will reproduce his movements of the past.

On the negative side, the BitGrail exchange suffered a hack several years ago and more than 10% of the Nano supply in circulation is still believed to be held by the hacker behind the attack. This can scare off investors since the hacker can sell their Nano coins at any time.

Interoperability

Polkadot (DOT)

If we have to name the most serious competitor to Ethereum, the Polkadot project comes to mind directly.

We are not talking here about yet another “Ethereum Killer”, but about a project that could eventually cohabit with Ethereum.

Carried by the famous Gavin Wood, co-founder of the Ethereum blockchain, Polkadot is an interoperable protocol developed to build Web 3.0.

Polkadot is special since it connects several specialized blockchains into a single unified network. It comes with DOT, its native cryptocurrency with many roles.

Using its many components, Polkadot’s complex architecture is completely compatible with other blockchains. A feature that allows Polkadot to connect and secure unique blockchains, whether public networks, private consortium chains, oracles, or other Web 3.0 technologies.

At the same time, Polkadot lends itself very well to the development of decentralized applications, providing developers with a range of technical tools and above all sufficient scalability capabilities.

At the heart of Polkadot is therefore the DOT token. A true engine of the protocol, the DOT has 3 main functions: ensuring network governance, linking the sub-blockchains to each other, and staking.

Since hitting the markets in 2020, the DOT has been impressive. In just a few months of existence, it has risen through the ranks, landing in the top 5 of the most capitalized cryptocurrencies, even surpassing Ripple’s XRP at the start of the year.

Polkadot and its DOT token are already in the big leagues, alongside Cardano and Ethereum.

The project has already won over many app developers, and DeFi is growing rapidly on the network. These include the decentralized exchange Polkastarter or the Reef Finance protocol, a multi-chain DeFi aggregator.

The year 2021 for the DOT looks promising. The team is very active and the use cases of Polkadot and its token are only increasing over time, all at a rather steady pace.

The ecosystem is developing well, it could be wise to follow its evolution to identify projects with potential. Here are some sample projects based on Polkadot:

Polkastarter (POLS): a decentralized exchange allowing projects to raise funds;

Kusama (KSM): an experimental network for Polkadot;

Acala (ACA): a para-chain dedicated to DeFi.

The top 12 promising cryptocurrencies for the year 2024 is now over. Which ones have you already invested in and what are your price targets for next year? Do not hesitate to provide additional information on the cryptocurrencies presented in the comments.