Philosophy of Cryptocurrency

History, nature and philosophy of cryptocurrency 2026

Since the introduction of the euro, we Europeans have become accustomed to going on vacation abroad without taking into account exchange rates and other local monetary specificities. And yet, this is not the case for everyone: everywhere outside of Europe, the slightest border crossing entails unwanted costs, and we often end up with unusable tickets in the bottom of our pockets when the trip is over.

The alluring idea of a universal currency has certainly been around much longer than the euro, but it was only recently that we were able to witness the birth of a real prototype: Bitcoin. However, many questions arise. Can Bitcoin be a global currency? What about other crypto-assets? What are the criteria for judging cryptocurrencies? Or, what will be their future?

To answer it, we will have to observe the birth of Bitcoin and its precursors, but also the development of the entire ecosystem of current crypto-assets. Then, we will study the nature and philosophy of crypto-currencies in general in order to reflect on the problems encountered in 2026.

The Birth of the First Cryptocurrency: Bitcoin

In 2007, a major financial crisis hit the world, from the most developed countries to those classified as “Third World”. Several simultaneous events lead to a sudden failure of a large part of the global financial system. The population then loses a large part of the confidence it had in the institutions.

And the events of the following years did nothing to improve this state of affairs: we can cite in particular the example of the Cypriot people, who saw their savings confiscated by the government and the International Monetary Fund, partly in order to reimburse debts accumulated by local bankers…

All of these events left a lasting mark on the middle and lower classes of global society, and were most likely the catalyst for the appearance of crypto-currencies, with the advent of Bitcoin in 2008.

Finally, on November 1 , 2008, a date that will certainly go down in history, Satoshi Nakamoto published the Bitcoin white paper . This stranger, or group of strangers, whose true identity remains unknown to this day, then revolutionized one of the pillars of modern society: money.

Indeed, Bitcoin simply represents the first currency with truly the potential for universality, and making it possible to overcome the various problems encountered in recent years: forced withdrawals from savings accounts, disproportionate inflation , etc.

We find this spirit of contradiction in particular in the introduction to the white paper: it is explained there that bitcoin is ” a purely peer-to-peer electronic money system “, having no need to “pass through an institution financial ”.

But is Bitcoin really an innovative concept from start to finish? After all, when we talk about all crypto-assets other than Bitcoin, we are talking about altcoins , which implies that they are secondary , and that Bitcoin is objectively the center of the cryptocurrency world .

In truth, there is no basis for any of this : in addition to fictional items such as Star Wars “credits”, whose equivalents can be found in various names and forms in other works, there are other cryptocurrencies that did indeed emerge before 2008.

What were they, and why did they fall into obscurity?

The precursors of Bitcoin, barely buried digital fossils

With the advent of the Internet and the popularization of personal computers in the 1990s, a large number of projects were launched to set up electronic money systems. Obviously, they did not all correspond to the criteria that we set today when we mention cryptocurrencies; however, it is worth mentioning them in order to put Bitcoin in its place: that of a prototype a little more successful than the others, quite simply.

We can cite in particular, among the ancestors of Bitcoin who passed away without becoming famous:

- The DigiCash, ecash, or even Cyber Bucks, was imagined by David Chaum in 1983 and launched in 1995. The latter collaborated directly with American institutions in order to set up a reliable and legal network. However, the imagined network being centralized and expensive to use did not develop and the company went bankrupt.

- CyberCash / CyberCoin was imagined in 1994 and launched shortly after. Yet another centralized system, presumably suffered from security issues and the Year 2000 bug, which resulted in large financial losses due to a double-spend phenomenon. The company closed its doors in 2001 following these events.

- The NetCheque, Danmont cards, or the Mondex system, among others, were to serve as currency, not universal but electronic. They all disappeared with the adaptation of banks to the Internet world, which quickly ceased to need these intermediaries.

If you want to read what the journalists of the 1990s thought of these solutions, you will find in particular in this article from 1994 an overview of the ideas conveyed at the time.

The most interesting of all Bitcoin ancestors, however, remains e-gold. It was an electronic currency whose value was calculated from the price of gold, like many tokens in existence today, such as the PureGold Token. Founded in 1996, the company that distributed e-gold didn’t begin to see success until much later. It was therefore in 1999 that the Financial Times described e-gold as “the only electronic money that has reached critical mass on the web”.

Between the years 2000 and around 2004, e-gold was partly comparable to Bitcoin: it allowed instant micro-payments via the internet, it was relatively well known, and was notably linked to many precious metal exchange platforms, which allowed its users to perform arbitration. However, it was a centralized system, which caused its downfall.

Indeed, criminals have taken over e-gold just as they later took over Bitcoin: scams, Ponzi schemes, bogus sales, and hacking have proliferated. Quite naturally, the American government ordered the disappearance of this system, so that these problems disappear with it.

Today, no one talks about e-gold anymore and few remember it. This is a lesson for Bitcoin maximalists, who all too often give Bitcoin near-godlike status.

As you have seen, Bitcoin is therefore not even the first to have offered a sufficiently secure and practical solution to become popular. So why was it so successful? It’s actually very simple: it brings together all the valuable features of previous networks, adding a new one: decentralization. Because it is the centralization that led to the fall of its ancestors and in particular that of e-gold, which disappeared following the decision of the American courts. Bitcoin, due to its decentralized nature, cannot suffer the same fate.

The circumstances of the economic crisis also favored its development. From 2008, a monetary system sheltered from all imaginable banking and political manipulation was ideal in everyone’s eyes, and immediately built up a good-sized user base.

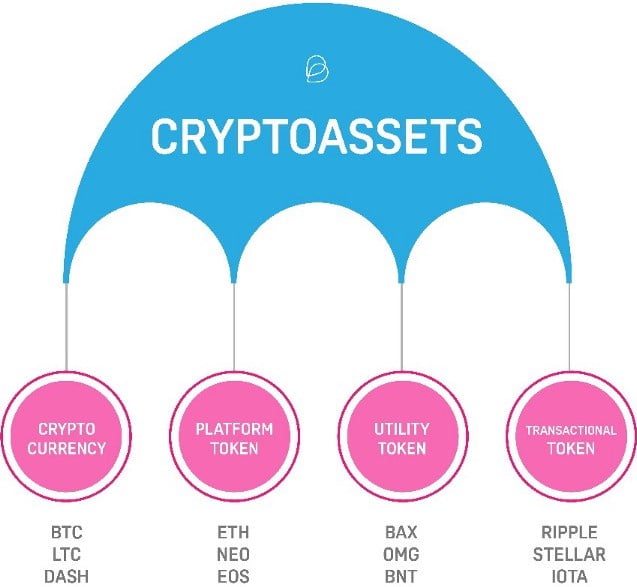

Today, many Bitcoin successors, cousins, and clones have emerged, some more useful than others. We are therefore going to study the main crypto-currencies existing in 2018, as well as a few others that have already disappeared in the meanders of the Web.

Cryptoassets in 2026

After the publication of Satoshi Nakamoto’s white paper, many new cryptocurrencies have emerged.

The first of these was Namecoin: its objective is not the decentralization of money, but that of internet domain names. Indeed, the latter is mainly regulated by American authorities, a decentralized alternative would allow the advent of a freer Internet. Today, although Namecoin still exists, its network seems deserted, as evidenced by this study dated June 2015, in which it is notably explained that of the 120,000 Namecoin domain names, only 28 are actually used by their holders…

Then came Litecoin and Ripple , two alternative currency systems to Bitcoin.

Litecoin is essentially a clone of Bitcoin but brings a new transaction validation algorithm, Scrypt is still considered one of the most important crypto-assets today. However, this importance stems in large part from its seniority, this crypto-currency having brought no truly innovative element at the technical level, and ultimately suffering from the same scalability problems as Bitcoin.

Ripple is also one of the crypto-assets still considered important in 2018, but it has the advantage of being an entirely original creation. Indeed, it was imagined in 2004 and finally saw the light of day in 2012, therefore having little in common with Bitcoin. It is indeed much more centralized, since to date only existing network nodes have been selected directly by the company Ripple Labs. Many also criticize Ripple for its unequal distribution ( example 1 and example 2 ): indeed, it would seem that more than half, and perhaps up to 80% of all existing Ripples are held in the hands of a single person (individual or company).

Then appeared crypto-assets of a more original nature: we will mention in particular Monero, Ethereum, then crypto-assets based on DAGs such as NANO.

Appeared in 2014, Monero aims to overcome a major problem of Bitcoin: the non-fungibility of Bitcoin coins. That is, due to the nature of bitcoin, the path that each bitcoin has traveled since it was mined is recorded, cataloged, and can be traced. As a result, a bitcoin that has been used for criminal activity is, therefore “dirty” forever.

This is one of the problems that cryptography specialists were already talking about in 1994 in the article you may have read: without the fungibility of electronic money, privacy is dead. Monero is therefore a first attempt to solve this problem. And many have also decided to make their own copy with the modifications of their choice: there is therefore today a whole ecosystem of cryptocurrencies based on Monero.

In 2015, Ethereum appeared. Created by Vitalik Buterin, a Russian-Canadian student, it is the first crypto-asset designed for the sole purpose of facilitating the establishment of smart contracts. These are actually programs that exist on a blockchain and allow you to perform certain tasks completely independently.

Other projects had imagined such concepts before: we will mention in particular Ripple Labs which had conceptualized this under the name of Codius in July 2014, although nothing finally saw the light of day until 2018.

Finally, we have recently seen the advent of the last category of crypto-assets: those based on directed acyclic graphs. Rather than always placing blocks in a predefined order, DAGs have a chaotic nature and do not necessarily arrange transactions in a single order. This mode of operation allows them to achieve transaction speeds unmatched by the blockchain to date, despite the occasional appearance of a few other concerns relating to consensus or centralization.

Among the crypto-assets based on the DAG, the most famous is certainly the NANO: formerly called Raiblocks (XRB), this cryptocurrency was created by Colin LeMahieu, formerly a programmer at Dell then AMD. The distribution method is chosen, that of the faucet, as well as the incredible speed of transactions quickly propelled this crypto-asset to the top of Coinmarketcap.

However, it is not the only DAG-based crypto-asset, nor the oldest. Indeed, we can cite in particular in this category IOTA, whose objective is to be used for micropayments in the context of the Internet of Things, or Byteball, an unknown crypto-asset that was the first to allow the implementation of smart contracts on a DAG…

As we have therefore seen, the term crypto-assets very clearly includes a heterogeneous set of objects based on completely different technologies. Does this prevent giving a general definition to crypto-assets, or even separating the wheat from the chaff? To answer this, we will take a closer look at the Bitcoin white paper, which was the catalyst for this revolution.

Nature and Philosophy of Cryptocurrencies

When Bitcoin was launched in 2008, Satoshi Nakamoto’s goals were relatively clear. Although no paragraph is dedicated to the reasons for his project or his philosophy, certain sentences and expressions are particularly appealing. We, therefore, invite you to read this white paper for yourself before continuing to read this article. It is located at the address to which this link points.

A purely peer-to-peer electronic money

The very first words of the white paper already tell us what the main objective of Bitcoin is: the creation of purely peer-to-peer electronic money. What does this expression mean? The answer is simple: a peer-to-peer system is a system that operates without any intermediary between the participants. Everyone is equal within the system.

A purely peer-to-peer electronic currency must therefore operate without banks and without governments, and must allow individuals to transfer value in the same way as they exchange hard and soft coins. This was not the case with the predecessors of Bitcoin that we saw above, since the latter worked only through servers belonging to the companies that created them. Most were anonymous and cryptographically protected, but their existence depended on that of the company that created them.

But is the electronic money function the only one that is really important? Hard to say. From a societal point of view, it is indeed the power to control the money that is at the center of the invisible conflict between cryptocurrency and the institutions of the world.

However, as many crypto-assets such as Ethereum, NEO or Lisk have been able to demonstrate, it is not necessary to be used as a currency to generate value and contribute something to our society. The simple fact of allowing the implementation of new processes can open the way to new professions, to new modes of exchange, and the creation of wealth.

In addition, it is also not necessary to have been created as a currency to be used as a currency: for example, despite its status as a platform for the creation of tokens and smart contracts, Ethereum is very often offered as an alternative to bitcoin by merchants who accept cryptocurrency payments.

Crypto-assets, whatever their category, therefore, all seem to have the same objective, although by various and varied paths: it is to allow individuals to become financially independent of any outside entity. But the reality is not always so simple, and it is by looking at the problem of trust and consensus that we can determine which cryptocurrencies truly pursue this ideal.

The issue of trust

The two notions of trust and consensus, briefly mentioned in the Bitcoin white paper, nevertheless remain at the center of the ideal of freedom promoted by the crypto-asset revolution.

Trust, first, is fundamental because it is what gives any currency its value.

In the Bitcoin white paper, Satoshi Nakamoto referred to intermediaries in the context of online payments: the third parties such as PayPal through which payments pass. The minimum objective of a crypto-currency worthy of the name would therefore be a priori to allow a direct transfer of value between two people, instantaneously and without the intervention of a third party.

But let’s look at it from another angle: fundamentally, when exchanging cash for goods and services, each of the parties to the transaction implicitly places their trust in the entity issuing said currency.

Thus, the use of a crypto-currency worthy of the name should in principle make it possible to dispense with any trust in a third party entity since the code and the mathematical laws must be the only masters in the matter. This already disqualifies a large number of current crypto-assets: many allow the spontaneous creation of coins or tokens by their creators; others have no real fixed rules as to the total amount existing… Our trust must be in the hands of these people.

In fact, even Bitcoin is to some extent subject to the will of third parties: since 2014, a company called Blockstream, made up of people to whom Satoshi Nakamoto had entrusted certain important codes, which takes care of maintaining and improving bitcoin code. It is therefore this company that alone decides on the technological improvements to be made to Bitcoin and consequently could change major rules concerning it overnight.

The ideal crypto-currency is therefore freed from the burden of trust, and should only be subject to the mathematical rules defined by its code.

However, this is not the only thing to analyze, since the consensus method used is just as important.

The problem of consensus, devoid of a perfect solution so far

As you probably already know, consensus methods are, in cryptocurrency, the mathematical processes by which the validation of transactions is carried out. For Bitcoin, this is Proof of Work. For others, more experimental, various processes have been devised, and all have their advantages and disadvantages.

But rather than talking about technique, we’re going to talk about power. Because that’s what it’s all about: the consensus method actually determines how power is distributed within the community. And this is where the words “centralization” and “decentralization” come in: the more power is held by a large number of people in equal shares, the more decentralized a cryptocurrency is. And the more power is centralized, the more it is held by a limited number of people.

This notion is sometimes vague: it should not be confused with that of distribution, which is an entirely different problem.

Simply put, distribution is the problem of concentration of wealth, while centralization is the problem of concentration of power.

In traditional societies, the concentration of power and wealth often go hand in hand. While in the world of cryptocurrency, things are sometimes quite different. In fact, it all depends on the consensus method.

Because some methods of consensus are close in nature to the oligarchy, which means that the rich have a power superior to the others. These include Masternode systems, which require immobilizing a significant amount of assets before holding any power over the network.

Does this mean that Bitcoin and its famous Proof of Work are unattainable by any criticism? Hard to pretend. Indeed, on the scale of a network of specialists, very little is used, the Proof of Work allows all minors to make their voices heard. But as soon as the network grows and the number of users increases, catastrophe: mining farms and mining cooperatives appear, in search of profitability.

And what exactly are mining farms, if not a collection of supercomputers all controlled by one man, or sometimes one company? As for the miners’ cooperatives, it is not much better: although many miners participate, the “manager” of the cooperative often remains the only real master on board.

Addendum: For “mining pools” in which several “big” miners are found, the decision-making power can sometimes be shared between the miners in the manner of a traditional company. The problem of the centralization of power in mining cooperatives applies especially to those whose model is similar to NiceHash, where individuals mine a crypto-asset without having any control over the result of their work.

The simple rental of computing power by an attacker would make it possible to set up 51% attacks on a very large number of blockchains, for very modest costs given the potential benefits.

However, in the case of Bitcoin, at present, if we consider only the four largest sources of calculations carried out, we arrive at more than 50% of the total computing power provided to the network by humanity.

This means, in short, that the four people holding the entities that generate this computing power have enormous power over Bitcoin. And, if they wished, the latter could quite ally to modify the blockchain according to their wishes.

It is therefore a problem questioning the validity of Bitcoin in its entirety. Because if we look closely at the white paper, Satoshi Nakamoto writes, in particular, the following sentence: To solve this, we proposed a peer-to-peer network using proof of work to record a public history of transactions, which quickly becomes computationally inconvenient for an attacker to modify if honest nodes control the majority of the computing power.

But as it was so well written, this security is only valid if honest nodes control the majority of the computing power.

In other words, the decentralization and security of the Bitcoin network rest on an idea in which there are an immense number of miners whose computing power is equal, and where it is therefore impossible to corrupt enough miners to alter the blockchain.

This ideal died long ago when BTC rose in value and the first mining farms appeared. From there, the imbalance between the miners grew and centralization began.

Also, many people don’t understand how network security works. I am thinking in particular of all the Bitcoin maximalists, taking pleasure in systematically belching the term 51% attack. It is in fact an extreme simplification of the principle of mining with proof of work, assuming that a modification of the blockchain by a single entity is only possible when this entity holds more than 51% of the power of total calculation.

This assumption is entirely false. Indeed, as you will be able to understand in this document, this mythical figure of 51% in fact only represents the moment from which the probability of success is 100%. But from 30% of computing power held by a single entity, the probability of succeeding in creating “false blocks” is already around 50%.

You will therefore understand that today, even Bitcoin, which for many represents an ideal, is currently, in fact, much more centralized than it should be. And that’s unfortunately an inherent flaw in Proof of Work as we know it. Thus, eventually, all cryptocurrencies based on a proof of work modeled on that of Bitcoin will eventually suffer from the same problem if their value increases. Mining farms and miner cooperatives will emerge, taking control over the network through overwhelming computing power.

Of course, this is not a guarantee of a double-spend attack, only a guarantee of the possibility of a double-spend attack. In a way, it’s a little bit like the difference between guaranteeing that your car’s engine will explode the next time you start it and guaranteeing that the engine might explode the next time you start it. Anyone in their right mind will scrap this car rather than drive it again, even if the risk is low.

In addition, this problem raises another question: what if the community becomes aware of manipulation by an entity holding the majority of power, and rejects this manipulation? Then a fork will occur, and a new cryptocurrency will appear. But this new crypto-currency will most certainly be based on the same algorithm… This means that sometime later, the same problem may reappear.

The possibility of forking therefore only shifts the problem and solves nothing, unless a change in the consensus method is made at the time of the fork.

In short, Bitcoin and its proof of work are just as open to criticism as other recently invented consensus systems. To date, none is perfect, and each of these systems decides to make different compromises. Some are faster and less secure, et cetera.

We therefore cannot really say that a crypto-currency does not deserve this name if its consensus system is imperfect. The only criteria one can apply to determine if a cryptocurrency has an acceptable consensus system is: is it designed to be centralized?

If so, then, generally speaking, the cryptocurrency using it is really just a Monopoly currency in disguise, wanting to cash in on Bitcoin’s notoriety. Because it is only through decentralization that users of crypto-currencies will achieve a real form of financial freedom, which is the desired objective of this revolution.

Distribution, or the problem of the concentration of wealth

We briefly mentioned the difference between distribution and centralization above.

To put it simply, an unequal distribution is to be rejected. This, for several reasons:

- The more unequal the distribution, the faster the price rises. Why? It’s quite simple. In this case, only a small percentage of the total is bought and sold by people outside the circle of the “lucky ones” holding the majority. So, the crypto-asset seems to be scarce, and people are willing to buy it more than they should. This, in turn, increases the capitalization of the relevant crypto-asset and propels it to the top of sites such as Coinmarketcap. This is an insidious form of manipulation aimed at making the crypto-asset appear larger than it really is, through unduly inflated capitalization.

- The more unequal the distribution, the greater the possibility of immediately dividing the price by 10, 20, or more. Imagine that, overnight, 50% of all Bitcoins were resold at market price: the result would be catastrophic, with Bitcoin at less than €50 in a few minutes. This further allows manipulators to buy back immediately at a low price by capitalizing on the fear of smallholders who would be pressured into selling to them for a fraction of the previous value, thereby generating cash AND buying back any tokens sold just before.

- The more unequal the distribution, the more the big holders will be tempted to manipulate the market in various ways, whether through disinformation campaigns, the placement of fake sales walls, or even meticulously elaborate disinformation.

All this leads to excluding Ripple in particular from the list of crypto-assets deserving your attention. Indeed, as we mentioned above, it would seem that more than 80% of Ripple tokens are in the hands of less than ten people. Ripple’s objective is therefore clear and defined: to manufacture money ad infinitum for the one and only benefit of this small group. Realize this: these people have made tens of billions of dollars out of thin air.

In contrast to Ripple Labs, there are people like Colin LeMahieu, creator of the NANO, also mentioned above. The NANO, then called Raiblocks (XRB), was fairly distributed through a website asking for daily action to get a small amount, absolutely free until enough people got some. . In particular, this has enabled many disadvantaged people in South America to lift themselves out of poverty. Which of the two, between Colin LeMahieu and the Ripple company, seems the most honest? The question shouldn’t even be asked.

By itself, the distribution of a currency does not prove anything about the nature of the technology, or the true potential of the crypto-asset in question, but it is a clue to determine the exact intentions of its creators. And if the intentions of the creators are nefarious, then it’s usually best to steer clear.

Privacy, an essential and yet often forgotten element

One of the least commented-on elements in the Bitcoin white paper is the paragraph on privacy.

Satoshi Nakamoto briefly explains the differences between the traditional model and his own: in fact, it is a question of stopping the flow of information accessible to the public at a different place. Rather than hiding everything, Bitcoin hides only what is necessarily hidden: the real identity of the parties to the transactions.

However, this poses a major problem that Satoshi Nakamoto did not fail to point out. Indeed, he takes the time to specify that a new key must be used for each transaction to avoid allowing the public to link sums to a common owner.

And the risk was already obvious in 2008: if the owner of a key sees his identity revealed, it suffices to retrace his steps on the blockchain to know all his activity.

Bitcoin, therefore, offers no real protection of privacy in practice, and Satoshi Nakamoto knew it. Does that mean that privacy is irrelevant? As many societal developments, this decade has proven, privacy leaks can destroy anyone’s life. Particular mention should be made of the various people sentenced to death for apostasy because their religious opinions were revealed following “leaks” of elements published on social networks ( example 1, example 2 ).

We could one day suffer the same fate for much more innocuous reasons. For example, what would happen if you bought alcohol with bitcoin and then went to travel to a country where the possession of alcohol is punishable by imprisonment, as was the case in the United States in the last century?

Also, always keep in mind that what’s legal today may not be legal tomorrow. If ever a fascist regime of croissantphobes were to emerge, you could well end up in prison for buying a croissant with Bitcoin.

Indeed, the Bitcoin blockchain leaves an indelible trace of all your transactions, which in turn gives incredible power to anyone who holds the secret of your identity. It is for this reason and many more that the protection of privacy is fundamental.

Here again, Bitcoin therefore totally fails to offer a viable solution.

How can you determine which cryptocurrencies deserve your interest?

Quite simply, it will be necessary to favor those allowing real anonymity of the users of the network, whatever the means used. Crypto-assets offering such features are still not widespread to date, but we advise you to learn about the entire ecosystem based around Monero, which offers transactions protected by some of the best cryptographic techniques aimed at ensuring anonymity…

In addition, a large number of other crypto-assets have appeared around Monero: a few competitors, but also and above all, many imitators having added or removed various features.

Today, it is difficult to judge crypto-assets by their privacy protection methods, given that this part of the equation has been relatively unexplored. Fortunately, we will certainly be able to see in the years to come to the maturation of this somewhat unique ecosystem. This will undoubtedly allow the advent of a real crypto-currency with all the ideal characteristics, including the anonymity.

Conclusion

Cryptocurrency still has a bright future ahead of it, but also a long, arduous and tortuous road. Many pitfalls must be overcome, both by creators and investors, and many objectives that sometimes conflict with each other must be achieved.

Today, the existing crypto-assets are ultimately only prototypes, despite the various preachers that can be found on the Internet. But maybe one day a perfect cryptocurrency will emerge; and perhaps it will be truly universal, peer-to-peer, fairly distributed, decentralized, trustless, and anonymous.

That day still seems distant, but that doesn’t mean we should lose sight of these goals. Because if just one of these elements were to disappear entirely from the ecosystem, then it would be proof that the crypto-asset revolution has failed. And the people would remain subject to the ruling classes and the bankers, who all too often have great powers without any accountability.

I trust you, dear readers, to invest in the projects that deserve it. It’s not necessarily obvious, but the future of a whole section of society is at stake.

Did this article help you ❤? Do not hesitate to let us know by assigning a rating out of 5 or by leaving us a comment 🙂

Resources:

It’s a peer-to-peer system that can enable anyone anywhere to send and receive payments. Instead of being physical money carried around and exchanged in the real world, cryptocurrency payments exist purely as digital entries to an online database describing specific transactions.

Investing in crypto assets is risky but also potentially extremely profitable. Cryptocurrency is a good investment if you want to gain direct exposure to the demand for digital currency. A safer but potentially less lucrative alternative is buying the stocks of companies with exposure to cryptocurrency.

Some cryptocurrencies offer their owners the opportunity to earn passive income through a process called staking. Crypto staking involves using your cryptocurrencies to help verify transactions on a blockchain protocol. Though staking has its risks, it can allow you to grow your crypto holdings without buying more.

Bitcoin is the digital currency that utilizes cryptocurrency and it is controlled by the decentralized authority which is not like the government-issued currencies whereas Cryptocurrency refers to the technology that acts as a medium for facilitating the conduct of the different financial transactions