Mine Bitcoin

Free Beginner Tutorial to Mine Bitcoin 2026

Mine Bitcoin is a process by which new Bitcoins are added to the network. It is crucial because it is how transactions are verified, and it also helps keep the Bitcoin network secure. It involves solving complex mathematical problems in order to earn the right to add the next block to the blockchain, with the winner being rewarded with bitcoins. A Proof of Work (PoW) mechanism is used to solve the puzzles, which is an energy-intensive process.

Today, it takes highly specialized equipment to successfully mine bitcoins, as the competition is tough.

Bitcoin mining details

This section will explore in depth what bitcoin mining is. Our goal is to give you a clear idea of what the process entails and to understand why miners are essential to the Bitcoin network. Additionally, we will give you tips on how you can profitably mine cryptocurrency today.

What is Bitcoin Mining?

In a centralized monetary system, the bank acts as an intermediary between two parties who wish to carry out a transaction. However, Bitcoin was created to serve as a decentralized version of a bank, where no single entity has control over transactions. In a centralized system, only the bank is authorized to update the Ledger. Because Bitcoin is decentralized, the role of updating the Ledger is left to network participants.

The question Satoshi Nakamoto had to face was: how to create a decentralized Ledger? How do you give someone the ability to update the ledger without giving them too much power that they become corrupt or careless in their work?

This is where Bitcoin mining comes in; anyone who wants to update the Ledger can do so, and all they need to do is guess a random number that solves a complex mathematical problem generated by the system. The guess is done using your computer, and the more powerful your computer, the more guesses you can make, increasing your chances of winning the right to update the Ledger.

If you guess correctly, you earn the right to add the next set of transactions, called blocks, to the Bitcoin blockchain – a decentralized public blockchain. As a reward for this effort, you receive a number of bitcoins.

Why are bitcoin miners important?

Miners are essential on the Bitcoin network as they help validate transactions, thus preventing double-spending. Until the advent of Bitcoin, creating digital currency was difficult; the innovators couldn’t figure out how to prevent individuals from duplicating transactions as one can easily do with a digital file.

But this problem has been solved by the introduction of the blockchain which makes it possible to timestamp the groups of transactions before broadcasting them to all the nodes of the network. Each block must contain a timestamp of the previous block included in its hash.

This creates an immutable record of how transactions took place. It can be said that the role of a miner is to determine which transactions are legitimate and which are not, and therefore are not taken into account. By doing this, miners help secure the Distributed Ledger against bad actors.

As mentioned earlier, this transaction validation process is both expensive and energy-intensive. This is why there are rewards in terms of bitcoins and transaction fees, which incentivize miners to continue their activity.

By doing so, Nakamoto was able to kill two birds with one stone: keeping the Distributed Ledger up-to-date in a decentralized way and introducing new coins to the network.

Bitcoin Mining Limitations

Nakamoto has pegged Bitcoin’s supply at 21 million coins. It is the maximum number that can ever exist, which, unlike fiat currencies that governments can overprint and devalue, guarantees stability and increases in value over time.

It is believed that Nakamoto was able to come up with this number after making two crucial decisions. The first was that new blocks would be added to the network after 10 minutes, and the second that rewards paid to miners would be reduced every four years or so.

Reducing the rewards offered is crucial as it helps to combat inflation within the network. Therefore, the amount of coins awarded to miners continues to drop after all 210,000 blocks have been mined, which is roughly every four years. Initially, the reward was 50 BTC, then it increased to 25 BTC, 12.5 BTC, and since last year, 6.25 BTC.

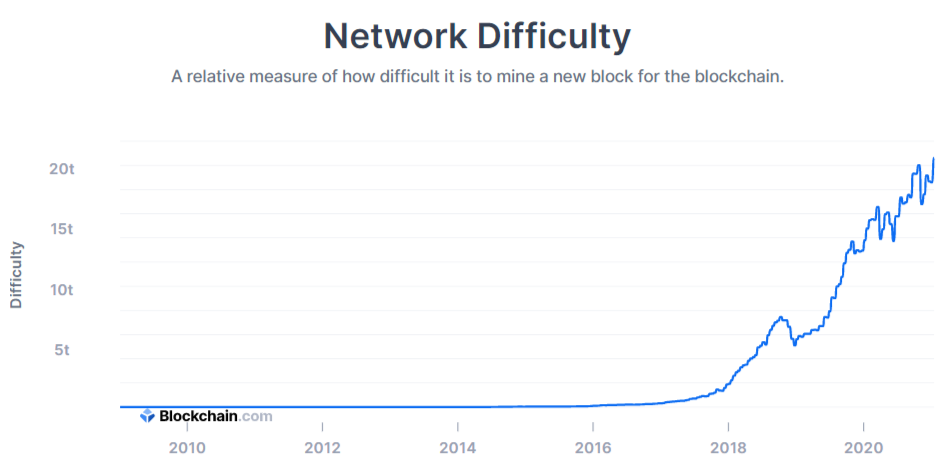

One could imagine that more and more people would want to participate in mining, some with even better mining devices to earn the maximum revenue. But Satoshi has come up with an ingenious method, known as mining difficulty, which ensures that only a given number of coins are added to the network after a given period, which in this case is ten minutes.

Mining difficulty is a self-adjusting process: the more miners in the network, the harder it is to mine. Conversely, if the number of active miners decreases, the difficulty decreases.

Tip to effectively mine Bitcoin to make a better profit

“ According to our research, there are two ways to do this. You can either invest in mining hardware and then join a mining pool or purchase a cloud mining service. If you choose the first solution, make sure you choose a pool based in a country where the cost of electricity is cheap and which offers regular rewards. If you opt for the second solution, take the time to research the best service providers and consider different factors such as reward share and contract terms to see if this is the best strategy for you. ”

The Technical Aspects of Bitcoin Mining Explained

This section covers the more technical aspects of Bitcoin mining, including defining terms such as hashrate and processing power. We will also see why it is better to have a higher hashrate within the Bitcoin network and how much is needed to successfully mine Bitcoin.

Simplified hashrate for Bitcoin

What does hashrate mean?

The hashrate is the number of guesses a Bitcoin mining machine can make in a given period. It is used to measure the computing power that all Bitcoin network participants contribute to Bitcoin mining.

Why is a higher hashrate important?

The higher a person’s hashrate, the more likely they are to mine bitcoins. A high hashrate of the entire bitcoin network means that more machines are participating in mining, which makes mining the coin more difficult. Hashrate is also used to measure the health of the Bitcoin network; therefore, a high hashrate is a good thing because it makes the network more secure.

If a malicious actor wanted to attack the Bitcoin network, they would have to control at least 51% of the entire hashrate, which would be quite costly when millions of machines are running. This means that the reward for hacking the Bitcoin network would be far less than the cost to the business.

How is the hashrate measured?

There are five hashrate measurement units: Kilohash, Megahash, Gigahash, Terahash, and Petahash. Currently, the most widely used unit is the Terahash (TH/s), which represents trillions of hashings/second. In the beginning, there were not many machines participating in Bitcoin mining; therefore, using your CPU, which is capable of around 5 MH/s, you could mine a few Bitcoins.

But, as the machines multiplied, the difficulty increased and the CPUs were replaced by graphics processing cards (GPUs), capable of producing at least 68 MH/s. Then came FPGAs, which were capable of 800 MH/s before ASICs took over. In the beginning, a standard ASIC was able to produce up to 1.5 TH/s, which is far from the capacities of current machines.

Processing power: CPU & GPU

Processing power represents the amount of useful work performed by a given computing device. The higher the processing power, the higher the hashrate of a given machine when it comes to mining Bitcoins.

In the beginning, since there were not many people mining BTC and the hashrate was low, it was possible to start the adventure with a standard multi-core processor. But a year later, in 2010, as more and more people joined the network, it was discovered that GPUs, which at the time were mostly used for playing video games, had superior processing power and offered better yields. In October 2010, the code for mining Bitcoin using a graphics processing unit (GPU) was released.

Remember that Bitcoin had no real value at that time, and cryptonauts and hobbyists did the mining. Interestingly, the first person to offer Bitcoin its first valuation was Lazlo Hanyecz, who in May 2010 bought two large pizzas for 10,000 BTC. You can do the math.

As the cryptocurrency community grew, so did the number of miners, which increased the level of difficulty.

By June 2011, field-programmable gate arrays (FPGAs) had become the norm, as they used three times less power than a simple GPU configuration to accomplish the same task. But it didn’t take long for more specific mining hardware to hit the market. FPGAs gave way to application-specific integrated circuits (ASICs), and Bitcoin mining went from hobby to industry. While FPGAs required modifications after they were purchased, ASICs were created for a specific purpose, namely cryptocurrency mining, which is why they have remained the norm.

The hashrate needed to mine Bitcoin profitably

Today, it is estimated that it takes around 72,000 gigawatts (72 terawatts) to mine one bitcoin using the average energy provided by ASIC miners. The current hashrate is around 133.732 Ehash/s per day, which means that very powerful and very power-efficient ASIC machines are needed to complete this task.

Mine Bitcoin PROs and CONs

PROs

- You have the opportunity to earn money by mining since you are rewarded in bitcoins

- You help the network verify transactions, keeping this decentralized alternative to banks alive

- It can be profitable if you mine in places where electricity is cheap

- Mining hardware retains its value and can be resold if one decides to stop mining

- You help maintain network security

CONs

- It is a very complex process that requires a good deal of research

- Bitcoin mining is very energy-intensive

- The machines needed to mine Bitcoin profitably are expensive

- Heavy research is needed to avoid mining pool scams

- You can make losses if the price of Bitcoin falls

- Cloud mining contracts don’t come cheap

DIY Mine Bitcoin – Getting Started

This section explains how to get started with Bitcoin mining. It will explore the type of software required and where you can purchase it. It will also cover the type of costs you are likely to encounter in this business and how to set everything up and get started.

The Best Bitcoin Mining Hardware

Individual bitcoin mining is not as profitable as it was in the early days of cryptocurrencies. It is still possible to undertake this activity profitably, but you will have to invest in great mining equipment, which is not cheap. The better your mining hardware, the more likely you are to mine more Bitcoins. We’ll cover a few machines below that you can consider for starters and on a budget.

The first is the Antminer T9+, a device that is not only cheap compared to others, but is ideal when you don’t have a large space to set up your operation. It comes with a compact design that makes it possible to cram multiple units into a mining farm. And with the built-in temperature reduction features, you’ll be able to save a lot on mining equipment. It costs around $550-600 and can be purchased from Amazon or the official Bitmain website.

If you are starting your journey as a bitcoin miner, you may want to consider Avalon6 which is relatively easy to use. It is not the most profitable compared to the others since it only manages to produce 3.5 TH/s for the 1050W it consumes. This one should set you back around $650 and you can find it on Amazon or the Canaan site.

If money is not an issue, you can consider the Antminer R4 which, like the Avalon6, is excellent for smaller applications. The fan on this machine has been redesigned to make less than half the noise other machines make when running, and it’s quite efficient. This machine will set you back around $1,700.

Currently, to access the best machines on the market, you have to spend large sums of money. These machines are absolute beasts and are in high demand, which means you have to join a waiting list to gain access to them. One such machine is DragonMint T1, created by Halong Mining.

It uses a state-of-the-art chip (DM8575), which allowed it to become the first ASIC to achieve a hash rate of 16 TH/s while consuming only 0.075J/GH. This one should set you back around $2,729. It rivals Bitmain’s Antminer S9, which consumes a bit more power but performs just as well. The Antminer S9 will cost around $2,767.

Visiting Bitmain’s online store, you will realize that they have even superior machines to come that have already been sold. These include the Antminer T19, which can produce an 84 TH/s hashrate but will cost you $2,118, the Antminer S19 with a 95 TH/s hashrate priced at $2,767, and the Antminer S19 Pro with a hashrate of 110 TH/s and costing around $3,769.

Other costs to consider

With these machines, be aware that the power supply and other components needed for set-up are sold separately. This, therefore, means that additional costs must be considered. For example, the Antminer S9 power supply will cost you an extra $150.

Then there is the energy cost which depends on where you are based. For maximum profit, you should mine in pools based in regions with cheap electricity, such as China.

Start mining!

To start mining you will need a bitcoin wallet, mining software, and hardware. The wallet will be used to store your rewards, while the mining software is what you will use to communicate between the hardware you are using and the Bitcoin network. The software will also communicate with the mining pool if you are part of it.

You can then join a mining pool or purchase a cloud mining service.

Some of the best mining software available include CGMiner, which offers remote interface capabilities, auto-detection of new blocks, multi-GPU support, fan speed control, and CPU mining software.

Another popular choice is BTCMiner, which is supported by FPGA boards for programming and communication and a USB interface. Its open-source, which means it does not require a license, offers the user the possibility to choose the frequency with the highest rate of valid hashes.

Other popular options include EasyMiner, which can run on Windows, Android, and Linux systems, MultiMiner, Bitminer, and RPC Miner, which is compatible with Mac OS.

When you join a mining pool, your decision will be based on several factors. You will need to consider the size of the pool. The bigger the pool, the higher the chances of winning rewards, but it also means that the payouts will be lower.

You can also opt for pools that focus on single or multiple coins depending on the hashrate of the network and which coin looks profitable at a given time period. Some popular mining pools based on strength and market share include F2Pool, Poolin, BTC.com, Huobi.pool, AntPool, ViaBTC, and Slush.

Mining solution/services

Mining pools combine the hashing power of all machines on the network to increase their chances of earning rewards. Mining pools or services are the only viable way to mine Bitcoin profitably for individuals today. You can choose to join a mining pool where you have to invest in mining hardware and get a share of the rewards, or you can opt for cloud mining services where you rent mining power and get rewarded.

Mining pools are not all remunerated the same way. Some will pay per share, which is the simplest payment system available. The advantage of this payment system is that it guarantees the miner to get paid whether or not the pool earns rewards. The payout here depends on the number of shares you hold, which is determined by your hashing power.

There is full pay per share, which is almost similar to pay per share, except transaction fees will also be added on top of the block reward.

Another payment scheme is pay-per-last N shares, which is a bit complicated and shifts the risk to pool members but offers more rewards. In this case, members-only gets paid once the block is found and transaction fees are not included.

The process of joining a mining pool is simple. For example, if you want to join Antpool, you need to acquire mining hardware, download mining software, then visit the pool’s official website and register.

But if you find the hardware investment and supervision of the mining operation too much to handle, there is another way to participate in Bitcoin mining while being rewarded. You can opt for cloud mining services, where you buy contracts and someone else does the mining for you.

However, you should be aware that this is a high-risk investment because when you buy a contract, you have to sign a clause that can lead to your account being closed if the price of BTC drops and your account doesn’t. is not profitable for a given period.

Among the most popular cloud mining platforms is Bitcoin Pool, which is owned by Bitcoin.com and offers some of the most competitive cloud mining services. It’s easy to set up and you can track your account using a mobile device. But plans don’t come cheap. A six-month contract costs around $5,000 upfront, with a daily fee of $15. A one-year contract will cost around $10,000 with a daily charge of $15, and a two-year contract will cost you around $13,000 with a daily charge of $15.

But be aware that your contract will end if the total income for the last 30 days is less than the total daily charges for the same period.

Other popular platforms are Hashnest, Hashflare, Hashing24, and Eobot.

Mine Bitcoin FAQs

How Long Does It Take to Mine One Bitcoin? In general, it takes about 10 minutes to mine bitcoin. However, this assumes an ideal hardware and software setup which few users can afford. A more reasonable estimate for most users who have large setups is 30 days to mine a single bitcoin.

It’s possible to mine Bitcoin without hardware by paying to use cloud computing resources, which is what cloud miners do. Cloud miners trade the cost of mining hardware for mining fees paid to cloud mining companies.

| Total BTC in Existence | 18,991,287.5 |

|---|---|

| Bitcoins Left to Be Mined | 2,008,712.5 |

| % of Bitcoins Issued | 90.435% |

| New Bitcoins per Day | 900 |

| Mined Bitcoin Blocks | 728,606 |

In February 2022, one Bitcoin mining machine (commonly known as an ASIC), like the Whatsminer M20S, generates around $12 in Bitcoin revenue every day depending on the price of bitcoin.

Crypto mobile mining – does it work? Yes, it does work. It is possible to mine bitcoin with an android device even if you might have numerous reasons to stay away from it. Also, using a mobile phone to mine crypto coins isn’t close to the way the traditional mining software or hardware works.

In simpler terms, crypto mining is five times more profitable than it used to be three years ago. Forward to 2020. One BTC was equivalent to $95.00. And the daily earnings of a crypto miner were around 0.0008 BTC.

Yes in most cases

Satoshi Nakamoto, the creator of Bitcoin, put a hard cap or maximum limit of 21 million on the supply, regulating it through an algorithm in its source code. The limited supply makes it a scarce commodity and can help increase its price in the future.

The easiest way you can get into bitcoin mining is by participating in cloud bitcoin mining. Cloud bitcoin mining allows for an individual to pay for the use of hardware and software needed for bitcoin mining without expending the cost of overhead associated with a personal mining rig.

The supply of bitcoin is limited to a final cap of 21 million. This is determined by bitcoin’s source code which was programmed by its creator(s), Satoshi Nakamoto, and cannot be changed. Once all bitcoin is mined, the number of coins in circulation will remain fixed at that level permanently.

Where should I keep my coins after mining?

Mined coins should be stored in a secure wallet if you don’t want to risk losing them. Bitcoin has great value, as its price can indicate, and many cryptocurrency enthusiasts are seeing the price soar to phenomenal heights. When it comes to wallets, there are plenty, as you’ll see in our recommendations. Hardware wallets are best for storing large amounts of coins, which you don’t intend to use anytime soon. If you want to trade or buy things with these coins, you can keep them on easily accessible software wallets.